bain capital tech opportunities fund l.p

Hayes was an Associate with Charlesbank Capital Partners LLC in the fall of 2000 where he focused on evaluating private equity investment opportunities in the energy and temporary staffing industries and analyzing trends in the leveraged buyout sector. Bain Capital Fund VI in 1998 was the last one Romney was involved in.

Industries Bain Capital Private Equity

Represented SDC Capital Partners LLC in connection with the 550m first closing of SDC Digital Infrastructure Opportunity Fund II LP.

. ADT MMC 2018 F Blocker LLC. We call it a Capitalist Kibbutz. Prior to joining Advantage Timur was a Managing.

Archer Capital Trust 5C. The New York native spent nearly two decades at Goldman Sachs where her roster of clients included L Brands Ralph Lauren Corp. Ares Credit Strategies Feeder.

Willkie Farr Gallagher LLP The group acts regularly on high-profile cases for notable clients including sponsors financial institutions and wealth managers with particular strength in advising on bespoke liquidity and capital solutions matters. Palamon Capital Partners is a private equity partnership. And KKR Co.

Goldman like other Wall Street firms routinely grapples. Veritas Capital a longstanding investor in companies operating at the intersection of technology and government today announced the successful final close of its Veritas Capital Credit Opportunities Fund with 400 million of aggregate committed capital. Timur has more than a decade of experience in private equity in a broad range of industries including services education industrials media and healthcare.

Dave received a BBA. Earnipay a fintech company that provides flexible and on-demand salary access to income-earners in Africa announced a US4 million Series Seed. BCSF is managed by BCSF Advisors LP an SEC-registered investment adviser and a subsidiary of Bain Capital Credit LP.

Bain Capital started out in 1984 counting former Republican presidential candidate Mitt Romney as one of its co-founders. Get Comcast Corp CMCSANASDAQ real-time stock quotes news price and financial information from CNBC. Horsley Bridge Strategic Fund LP.

High Court of Australia. The fund aims to provide investors with long-term capital growth principally through investment in the equity securities of companies throughout the world which are involved in the design manufacture or sale of products and services used for or in connection with health care medicine or biotechnology. Archer Capital GF Trust 2C.

Prior to joining Roark Dave was a Senior Associate at American Capital an investment fund with approximately 19 billion of capital under management. J-Ventures is a community-driven global venture capital fund of top investors executives and founders. Higher Education Standards Panel.

Prior to American Capital Dave was a Manager in the transaction advisory services group at Ernst Young where he worked on financial due diligence projects for private equity firms. Formerly known as Kohlberg Kravis Roberts Co. He held senior management positions at two successful start-up companies that were acquired and he has over 14 years of experience investing in the global healthcare sector both as a Partner and Managing Director at Matrix Capital Management and as a General Partner and Managing Director at Ayer Capital Management a healthcare-focused hedge fund.

Avid DIY carpenter and mechanic. Historic Shipwrecks Delegates Committee. A minimum of 50 of the funds net assets will be invested in securities.

Veritas Capital Announces Successful Close of Credit Opportunities Fund. Since commencing investment operations on October 13 2016 and through. AM Capital Opportunities AMCO with assets under management of approximately 500 million is AMCs lower middle-market growth strategy focused on shared control and structured minority equity investments in North America.

Based in Silicon Valley we operate as a collaborative community of leaders with shared values and a strong network of connected capital. Adams Street Global Opportunities Secondary Fund II-A LP. From 1996 to 1998 he was an Analyst with Merrill Lynchs Energy Investment Banking group in Houston.

Adams Street Partnership Fund - 2009 Non-US Emerging Markets Fund-A LP. Through Fund III Vance Street. Virginia Tech Master of Science Finance.

OMelveny represented Earnipay on the deal. Timur is a Managing Director in HIG. Bain Capital Tech Opportunities was created in 2019 to make investments in technology companies particularly in enterprise software and cybersecurity.

Ran with the bulls in Pamplona Spain. Insurance Insurance Our insurance team collaborates with leading insurance businesses and management teams to. Advent International GPE VII-F LP.

Highstar Capital IV-A LP. The Legal Entity Identifier LEI is unique global identifier of legal entities participating in financial transactions. The Firm manages funds with 13 billion of equity capital for investment and is backed by some of the biggest investment institutions in the world.

Tech Opportunities Tech Opportunities Our Tech Opportunities team aims to help growing technology companies reach their full potential by creating an end-to-end Bain Capital technology platform to invest at scale across stages and asset classes. Davis who was head of the retail investment-banking group is leaving to join Bain Capitals private equity group according to people with knowledge of the matter. Virginia Tech Bachelor of Science Biochemistry.

From full remodeling of kitchens and bathrooms to restoration and modification of carsanything. HERE Co-Investment Feeder Fund I LP. In addition to Hellman Friedman Bain Capital Private Equity and Bain Capital Tech Opportunities the investor group includes Veritas Capital and Evergreen Coast Capital which have each.

Fund III with 4325 million in commitments exceeding its target of 375 million. Our fund is backed by a connected capital. In line with its history of investing personal capital and its commitment to alignment of interests across all stakeholders the principals of.

Ares Credit Strategies Feeder Fund III LP. Capitals Advantage Fund and is based in the New York office where he focuses on investing in Technology Media and Telecom sectors. Cayman Islands Business Directory.

Los Angeles CA February 1 2022 Vance Street Capital Vance Street a middle market private equity firm held the final closing on December 31 2021 for its third buyout fund Vance Street Capital III LP. LP is an American global investment company that manages multiple alternative asset classes including private equity energy infrastructure real estate credit and through its strategic partners hedge fundsThe firm has completed more than 280 private equity investments in portfolio. Bain Capitals approach of applying consulting expertise to the.

Keystone Capital Management LP Keystone or the Firm is pleased to announce that it has held a first and final close of its debut institutional fund Keystone Capital Fund II LP Fund II with 420 million of capital commitments. Highstar Linden CIV II-B LLC. The firm oversees about 155 billion in.

Investors were worried that with Romney gone. Hillwood EU Industrial Club III SCS. HERE Co-Investment Fund I LP.

Highstar Linden CIV B Holdco LLC. AMCO partners with business owners and management teams to help recapitalize and grow businesses leveraging deep operational.

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Buyouts

Our People Bain Capital Tech Opportunities

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Bain Capital Targets 1 5bn For Second Tech Opportunities Fund Private Equity Insider

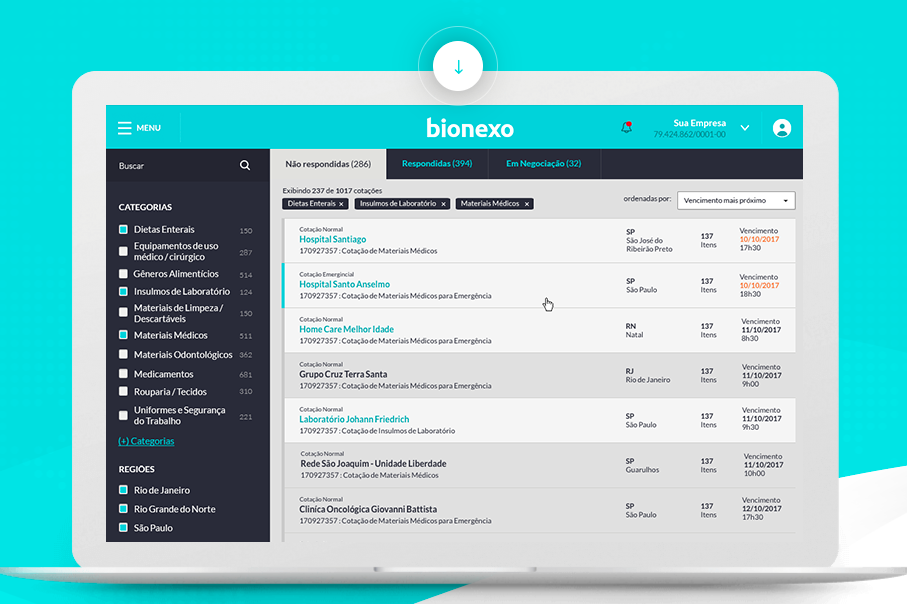

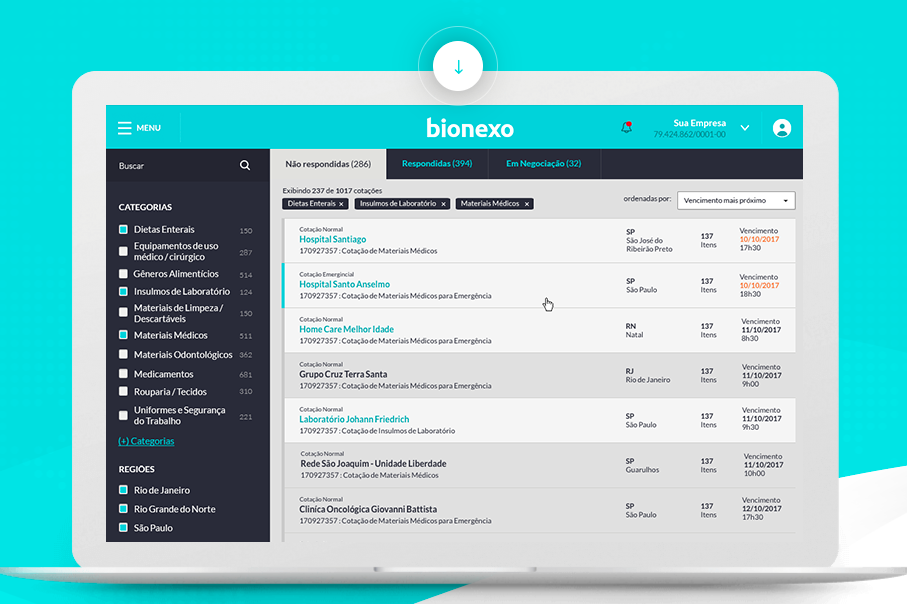

Bionexo Announces R 450 Million Investment From Bain Capital Tech Opportunities Bain Capital

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Bain Capital S New Technology Fund Makes Maiden Investment Wsj